green card exit tax irs

Giving Up a Green Card. Surrendering a Green Card US Tax Rules for LTRs.

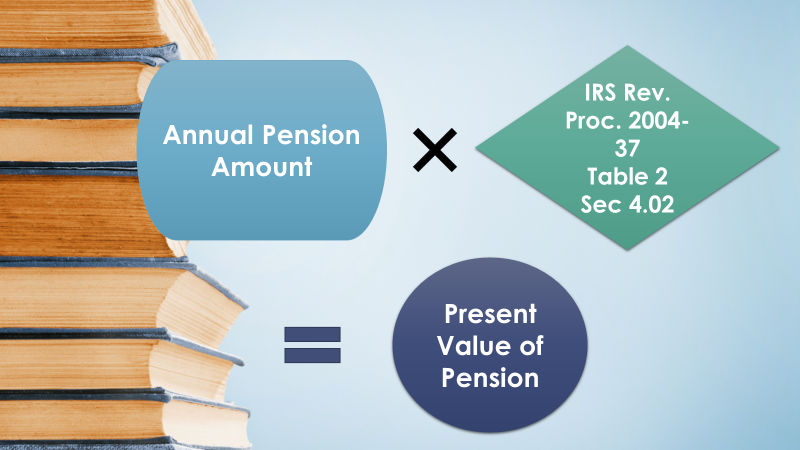

Valuation Of Defined Benefit Pension Plan In Exit Tax Cdh

If a non-US citizen obtains a green card aka Lawful Permanent Resident status they are still subject to US tax on their worldwide income even though they are a.

. Exit tax applies to. In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and.

When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. With the ever-increasing IRS enforcement of offshore accounts compliance and foreign income reporting the number of. Giving Up a Green Card US Exit Tax.

Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Giving Up a Green Card US Exit Tax. Exit Tax for Green Card Holders.

This is known as the green card test. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

US Exit Tax Giving Up a Green Card. Long-Term Resident for Expatriation. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

Irs Exit Tax For American Expats Expat Tax Online

Exit Tax Quintessential Tax Services Us And International Tax Services And Consultation

How The Us Exit Tax Is Calculated For Covered Expatriates

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Exit Tax Abandonment After 8 Years

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Forex Signals 105 Pips Gained By All New Webinar Attendees Itm Financial Leveraging Social Forex Signals Worldwide Forex Forex Signals Forex Financial

The Role Of Irs Form 8854 In Renouncing Us Citizenship Expat Tax Professionals

Us Expatriation Tax 2021 Exit Tax After Renouncing Citizenship

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renouncing Us Citizenship Expat Tax Professionals

U S Exit Tax Orlando International Tax Lawyer

Expatriation From The United States The Exit Tax

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Exit Tax How To Plan Expatriating From The U S New 2022