closed end loan definition

Since the lender is relying on these monthly interest payments your loan term may include prepayment penalties. The main difference between an open-ended loan and a closed-ended loan is the manner that the initial loan is disbursed and how the borrower is required to pay back the loan.

Buying Equipment Monroe County Ny Monroe County County Online Service

This payment includes interest and principal which slowly decreases your loan balance until its satisfied.

. A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get.

Closed-end fund definition. A closed end home equity loan is secured by your home as collateral. A closed-end loan is also known as an installment loan by traditional lenders.

A closed-end mortgage loan or an open-end line of credit to improve a multifamily dwelling used for residential and commercial purposes for example a building containing apartment units and retail space or the real property on which such a dwelling is located is a home improvement loan if the loans proceeds are used either to improve the entire property for example to. Auto loans and boat loans are common examples of closed-end loans. Youll have to apply for new credit if you need to borrow again.

A mortgage loan in which all sums have been funded at closingContrast with open-end mortgage in which the principal balance may increase over time. A closed-end or closed mortgage bars a borrower from using their home as equity or collateral on a second loan and imposes prepayment penalties. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

And b that is not unfunded cancelled or rescinded for any reason within five 5 days after settlement. Payments and the payment period remain the same throughout the life of the loan. Closed Loan means a consumer - purpose closed - end residential mortgage loan a that is closed and funded in accordance with Applicable Requirements in the period in which the Commission is calculated.

Unlike open-ended mortgages there are no savings involved in paying off the closed-end mortgage. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender. An example of a closed-end loan is a mortgage loan.

Closed-end credit is a lending option that allows you to borrow funds upfront and repay the entire amount with interest by the end of the borrowing term. A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a particular date. A closed-end fund or CEF is an investment company that is managed by an investment firm.

A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a particular date. After you repay your balance you cant use the credit or loan again. A closed-end mortgage is a mortgage agreement that does not permit a borrower to take an additional amount without repaying the current mortgage and taking permission from the mortgage lender.

With this type of loan you cant. The funds you apply for are disbursed all at once. What is Closed-End Credit.

Closed-end credit is a type of loan that you only take out once such as an installment loan. One of many loan products offered by lenders a closed-end loan is a loan that is paid to the borrower in a lump sum of money to be re-paid in full within a specified time frame. A closed-end signature loan is a type of personal loan that is typically available to people with good credit.

A close loan or close ended loan is a type of loan where the total amount of the loan is disbursed to the borrower who will need to pay back principal and interest over a certain period of time. Closed-end funds raise a certain amount of money through an initial public. These loans are normally disbursed all at once in order for the debtor to buy or achieve a specific thing and often the creditor gains rights to possess the item if the debtor fails to repay the loan.

With closed end credit you agree to a monthly payment that youll make until the end of the loan term. Closed-end mortgages are mortgage agreements in which the full repayment of the loan cannot be made prior to the maturity date of the mortgages. Such a loan is set up with fixed payments that cover both the principal amount of the loan and the interest due over the life of the loan.

Closed-end loans which include installment and student loans and automobile leases are generally charged off in full no later than when the loan becomes 20 days past due. And if you are 60 to 90 days late in making payments your lender may be forced to foreclose on your house. A home loan is typically a closed-end mortgagea construction loan is typically an open-end mortgage.

Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms. By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line. Further if you have chosen a loan with a variable rate you should be aware that your monthly payments will rise when interest rates rise.

A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest.

Thanks Diane And Danny For Your Feedback We Appreciate Your Trust In Us And Look Forward To A Lifetime Relat Investing Real Estate Investing Investment Group

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Good Faith Estimate Cost Sheet Worksheets

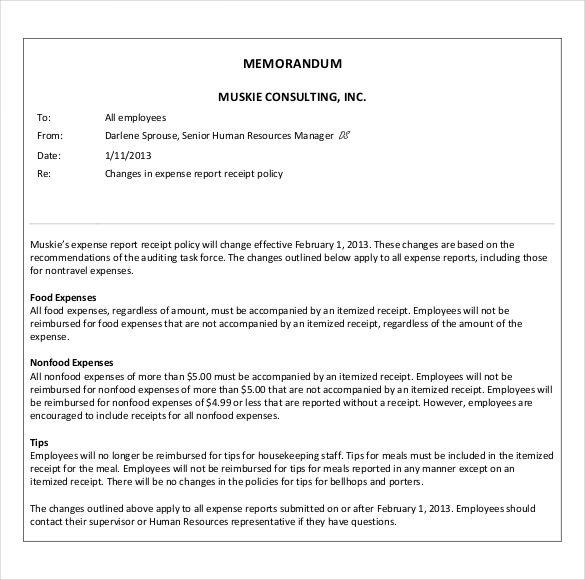

Mallainjulien Sample Company Memo 9bd433e7 Resumesample Resumefor Memo Template Business Memo Memo Template Word

Real Estate Investing Image Source Http Www Pm Consultinggroup Com Wp Content Uploads 2011 01 Istock Real Estate Investing Family Finance Smart Budgeting

Lss Project Charter Project Charter Project Management Agile Project Management

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Selling House Meant To Be Understanding

Underwriters Processors Fha Real Estate Home Decor Home Buying First Time Home Buyers Buying A House Home Bu Mortgage Tips Real Estate Quotes Usda Loan

Gtworld Vs Gtbank App Banking App Mobile Banking App Interface

Closing Costs Closing Costs First Time Home Buyers Closer

Dfiles Me Journal Entries Accounting Journal

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

An Appraiser Is A Trained And Licensed Person Who Visits A Property Analyzes It And Determines Its Approximate Value In 2022 Vocab Real Real Estate

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Top 7 Ways To Improve Your Credit Score Improve Your Credit Score Credit Score Improve Credit Score

Best Way To Pay Down 50k Credit Card Debt Bankrate Com Savings Calculator Bankrate Com Student Loan Calculator

Understanding Finance Charges For Closed End Credit

Each Individual Lender Bank Landlord Etc Has Their Own Personal Definition Of A Good Credit Score Good Credit Score Credit Score Good Credit

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)